A lot of people think insurance is too expensive, but the truth is, there are ways to get the protection you need without breaking your budget. It’s not about finding the absolute cheapest plan. It’s about finding the right balance between cost and coverage.

Here are a few tips to make insurance more affordable:

1. Compare different plans.

Don’t settle for the first quote you see. Look at a few providers and check what each policy actually covers.

2. Adjust your deductible.

A higher deductible usually means a lower monthly premium. Just make sure it’s an amount you could actually pay if you had to make a claim.

3. Bundle policies when possible.

Many companies give discounts if you combine Home Insurance and Life Insurance or other policies together.

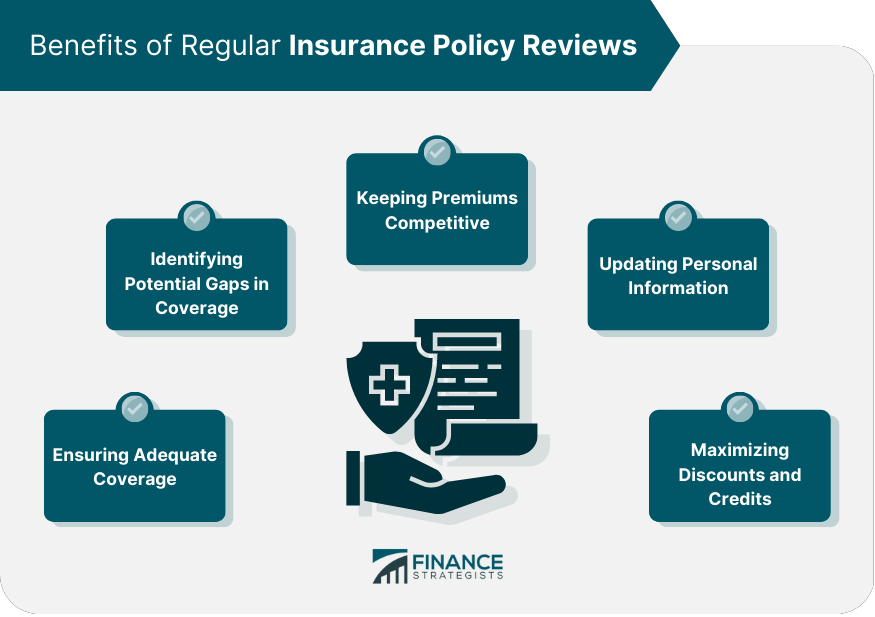

4. Revisit your policy regularly.

Life changes fast — new job, new house, new family members. Updating your insurance keeps your coverage accurate and sometimes even lowers your costs.

5. Focus on value, not just price.

Cheapest doesn’t mean best. It’s smarter to pay a little more for a plan that actually protects you when you need it.

Insurance doesn’t have to be a financial burden. With the right plan, it can fit your budget and give you peace of mind at the same time.

👉 Curious about your options? Get a free insurance quote today and see what works best for you.