Health insurance is one of the most important financial decisions you can make. It protects you from high medical costs, gives you access to better care, and provides peace of mind in uncertain times. Whether you’re looking for your first plan or want to better understand the one you already have, this guide will walk you through the basics.

What Is Health Insurance?

Health insurance is an agreement between you and an insurance provider. You pay a monthly fee (called a premium), and in return, the insurer helps cover medical expenses like doctor visits, hospital stays, medications, and surgeries.

Without insurance, even a single hospital visit can create bills that are difficult to manage. With insurance, those costs are reduced or shared, making care much more affordable.

Why Health Insurance Matters

- Financial protection: Unexpected health issues can be expensive. Insurance prevents those costs from becoming overwhelming.

- Access to care: Insured patients often have access to a wider network of doctors and hospitals.

- Preventive services: Many plans include checkups, screenings, and vaccinations at no extra cost.

- Peace of mind: Knowing you’re covered lets you focus on recovery instead of bills.

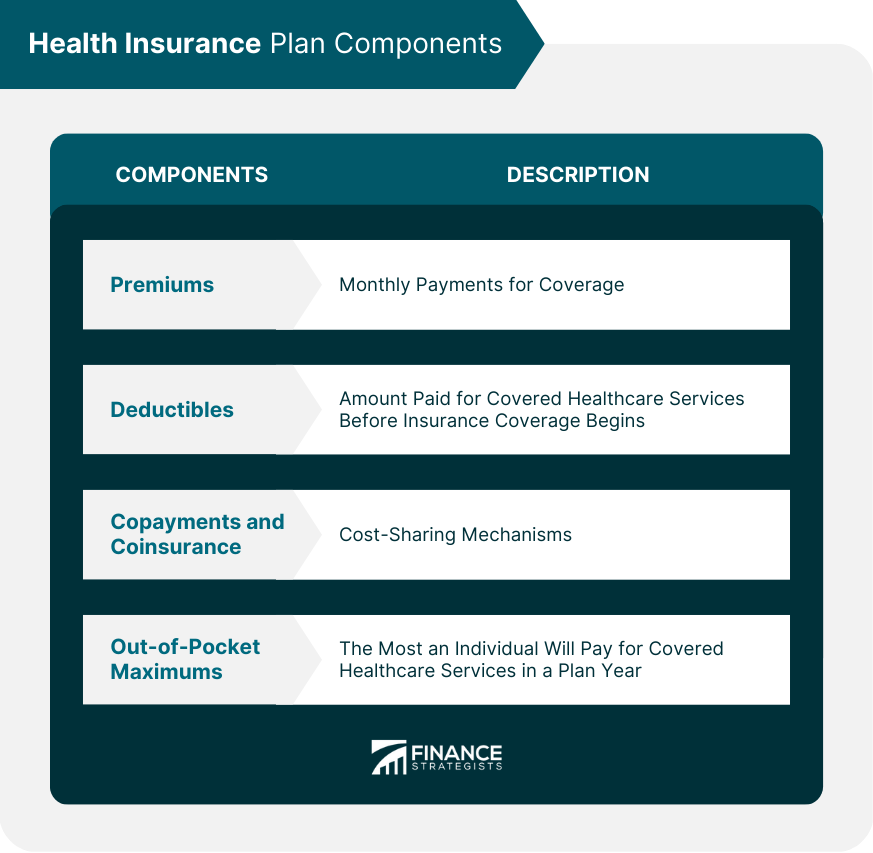

Key Terms You Should Know

- Premium: The monthly payment you make to keep your insurance active.

- Deductible: The amount you pay out-of-pocket before insurance starts covering costs.

- Co-pay: A fixed fee you pay for specific services, like a doctor visit.

- Network: The list of doctors, clinics, and hospitals that accept your insurance.

Types of Health Insurance

- Individual Plans – For people buying coverage on their own.

- Family Plans – Covers you, your spouse, and children under one policy.

- Employer-Sponsored Plans – Offered through a job; often includes partial employer contributions.

- Government Plans – In some countries, programs provide affordable or free health coverage.

How to Choose the Right Plan

- Consider your health needs. If you see doctors often, a plan with a higher premium but lower co-pays may save you money.

- Check the network. Make sure your preferred doctors and hospitals are included.

- Balance costs. Look at both monthly premiums and potential out-of-pocket expenses.

- Think about your family. If you have children, look for plans that cover pediatric care and emergencies.

Common Mistakes to Avoid

- Only choosing the cheapest plan without checking coverage.

- Ignoring the deductible and focusing only on the premium.

- Forgetting to update your policy after life changes.

- Not reviewing what’s excluded (some services may not be covered).

Final Thoughts

Health insurance isn’t just a financial product. It’s a way to protect yourself and your loved ones from unexpected challenges. By understanding how it works and choosing a plan that fits your needs, you can ensure that you’re covered when it matters most.

👉 Ready to explore your options? Visit our Health Insurance page or Get a Free Quote today.