Choosing an insurance plan can feel overwhelming. Between the jargon, the fine print, and the endless options, it’s easy to either overpay for coverage you don’t need or pick a policy that leaves you unprotected. The good news? Finding the right plan is easier when you break it down step by step.

Here’s a clear guide to help you make a smart choice.

Step 1: Understand What You Need

Insurance isn’t one-size-fits-all. The right plan depends on your stage of life, financial situation, and what you’re trying to protect.

- Health insurance: Do you need routine coverage or just protection from big emergencies?

- Life insurance: Who depends on your income, and for how long?

- Home insurance: What would it cost to rebuild your home and replace your belongings?

- Travel insurance: Are you taking short domestic trips or long international journeys?

👉 Write down your priorities before comparing policies.

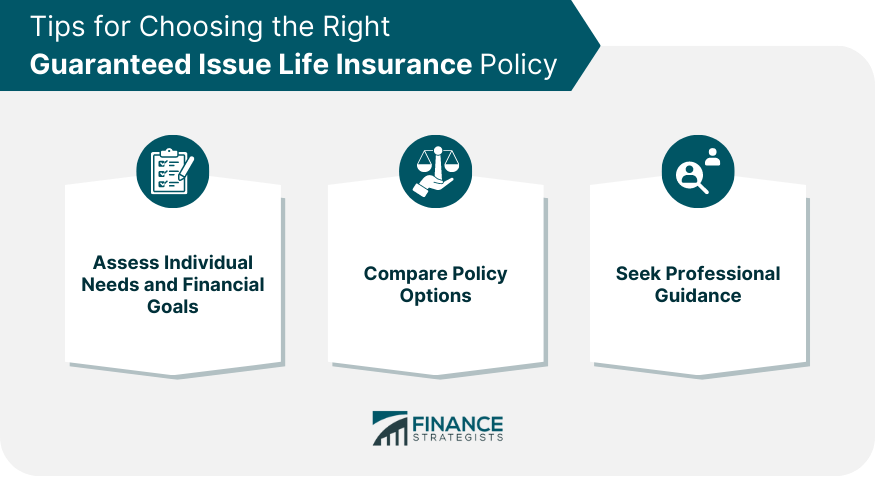

Step 2: Compare Plans Side by Side

Don’t stop at the first option. Look at at least three plans from different providers and compare:

- Premiums (what you pay monthly or yearly)

- Coverage limits (the maximum amount paid in a claim)

- Deductibles (what you pay before insurance kicks in)

- Exclusions (what’s not covered)

Sometimes a slightly higher premium offers much better protection.

Step 3: Check the Deductible

A deductible is the amount you pay out of pocket before your insurance starts covering costs.

- High deductible: Lower monthly premium, but bigger expense when you make a claim.

- Low deductible: Higher premium, but less upfront cost during emergencies.

👉 Choose based on your budget and how much you could realistically pay out of pocket.

Step 4: Look Beyond Price

The cheapest plan isn’t always the best. What matters is how reliable the insurer is when you actually file a claim.

- Read reviews.

- Check customer service ratings.

- See how quickly they handle claims.

A little research can save you big headaches later.

Step 5: Review and Update Regularly

Your insurance needs today may not be the same in five years. Marriage, kids, buying a house, or even changing jobs can all impact your coverage needs.

👉 Make it a habit to review your policies annually and update them when your life changes.

Final Thoughts

Choosing the right insurance plan doesn’t have to be confusing. Start with your needs, compare options carefully, and think about the long-term value instead of just the short-term cost. With a little planning, you’ll find coverage that fits your life and gives you peace of mind.

👉 Ready to explore your options? Get a Free Insurance Quote and find a plan that’s right for you.