Life insurance is one of the most important financial tools you can have. It’s not about you — it’s about the people who depend on you. If something were to happen, life insurance helps make sure your family is financially secure.

This guide breaks down the essentials so you can understand what life insurance is, why it matters, and how to choose the right plan.

What Is Life Insurance?

Life insurance is a contract between you and an insurance company. You pay a regular fee (called a premium), and in return, the company pays your beneficiaries (your family or loved ones) a sum of money when you pass away.

That payout, often called a death benefit, can cover things like daily living expenses, debts, education costs, or even a mortgage.

Why Life Insurance Matters

- Protects your family’s future: It replaces your income so your loved ones can maintain their standard of living.

- Pays off debts and expenses: Mortgages, loans, or medical bills don’t disappear when you do. Insurance prevents your family from carrying that burden alone.

- Covers education costs: Many families use payouts to fund children’s or grandchildren’s education.

- Peace of mind: Knowing your loved ones are financially safe allows you to focus on the present.

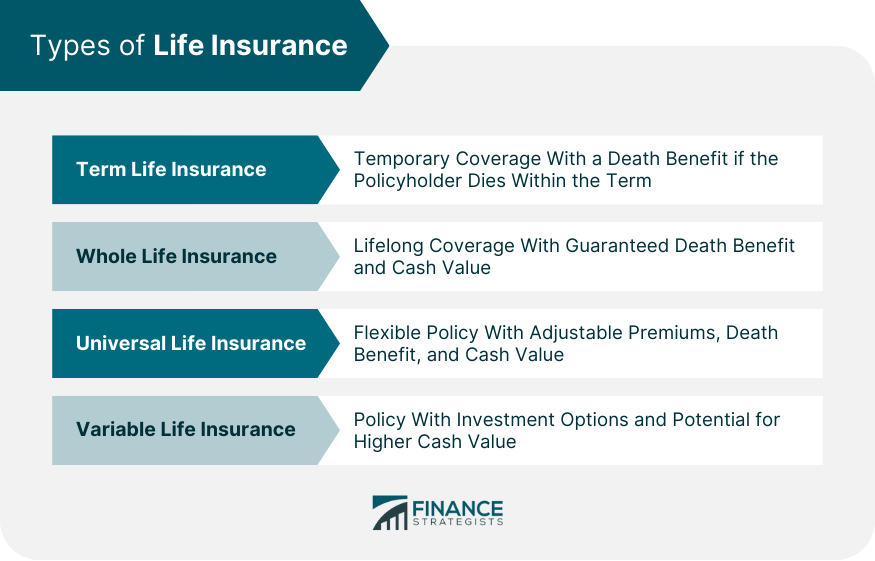

Types of Life Insurance

There are two main categories most people choose from:

1. Term Life Insurance

- Coverage for a fixed period (10, 20, or 30 years).

- Lower premiums, simple structure.

- Good for families on a budget or people who need coverage during their working years.

2. Whole Life Insurance

- Covers you for your entire life.

- Higher premiums, but it builds cash value (you can borrow against it or use it as savings).

- Works well for long-term financial planning.

Other types exist (universal life, variable life), but term and whole life are the most common for everyday needs.

How Much Life Insurance Do You Need?

A simple rule of thumb is to get coverage worth 10–15 times your annual income. But it also depends on your situation:

- Do you have children or dependents?

- Do you have a mortgage or large debts?

- Do you want to leave money for education or retirement needs?

The right amount ensures your family can maintain financial stability even without your income.

Common Mistakes to Avoid

- Waiting too long: Premiums rise with age and health issues. Starting earlier saves money.

- Underinsuring: Choosing a policy that’s too small won’t help your family much in the long run.

- Not naming the right beneficiaries: Always review who receives the payout, especially after life changes (marriage, divorce, children).

- Forgetting to update your plan: Life circumstances change. Your insurance should too.

Final Thoughts

Life insurance isn’t about expecting the worst. It’s about protecting the people you love. By understanding your options and choosing a plan that fits your needs, you’re giving your family security and peace of mind no matter what the future holds.

👉 Ready to take the next step? Visit our Life Insurance page or Get a Free Quote today.