For most people, a home is the biggest investment they’ll ever make. It’s where memories are created, families grow, and life happens. But just like any valuable asset, your home is vulnerable to risks — from fire and theft to natural disasters. That’s where home insurance comes in.

This guide will help you understand what home insurance is, what it covers, and how to choose the right plan for your needs.

What Is Home Insurance?

Home insurance (also called homeowner’s insurance) is a policy that protects your property and belongings. If your house or its contents are damaged, stolen, or destroyed, insurance helps cover the cost of repair or replacement.

It also includes liability protection, which means if someone gets injured on your property, your policy may help cover legal or medical expenses.

What Does Home Insurance Cover?

Coverage varies by policy, but most standard plans include:

- Dwelling Coverage: Repairs or rebuilds your home if it’s damaged by fire, storm, or other covered events.

- Personal Property: Protects belongings like furniture, electronics, and clothes if they’re stolen or damaged.

- Liability Protection: Covers you if someone sues after being injured on your property.

- Additional Living Expenses (ALE): Pays for hotel stays or rentals if your home is unlivable during repairs.

What’s Not Covered?

Not everything is included. Common exclusions are:

- Flood damage

- Earthquakes

- Poor maintenance or neglect

- Certain high-value items (like jewelry or collectibles) without extra coverage

For these risks, you may need add-ons or separate policies.

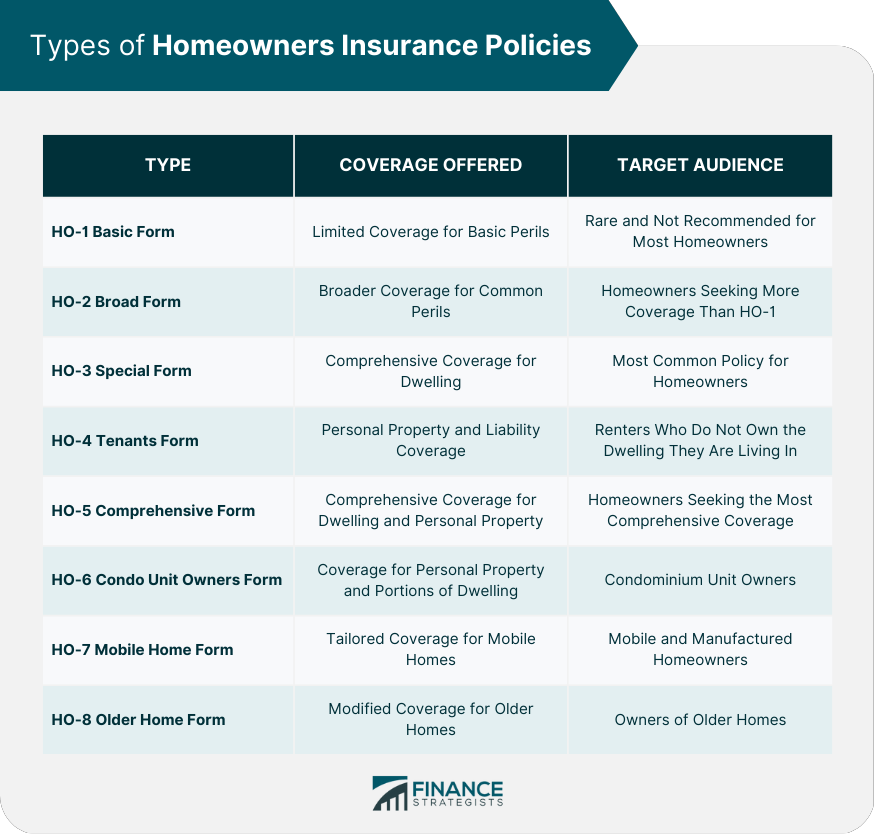

Types of Home Insurance Policies

There are several kinds, but the two most common are:

- Basic Policy (HO-1/HO-2): Covers specific risks like fire, theft, or wind damage. Usually more affordable but limited.

- Comprehensive Policy (HO-3): Covers all risks except those specifically excluded. This is the most common and flexible option.

How Much Coverage Do You Need?

Think beyond just the value of your house. A good policy should cover:

- The full cost to rebuild your home (not just market value).

- Replacement value of your belongings.

- Adequate liability coverage — at least enough to protect your savings and assets.

Tips for Choosing the Right Home Insurance

- Compare multiple providers — Prices and coverage can vary widely.

- Bundle with other insurance — Many companies offer discounts when you combine home and auto policies.

- Check deductibles — A higher deductible lowers your premium, but make sure it’s an amount you can afford to pay in case of a claim.

- Review annually — Update your policy as your home value and belongings change.

Final Thoughts

Your home is more than a building — it’s the heart of your life. Protecting it with the right insurance ensures that if the unexpected happens, you can recover without losing financial stability.

👉 Ready to learn more? Visit our Home Insurance page or Get a Free Quote.